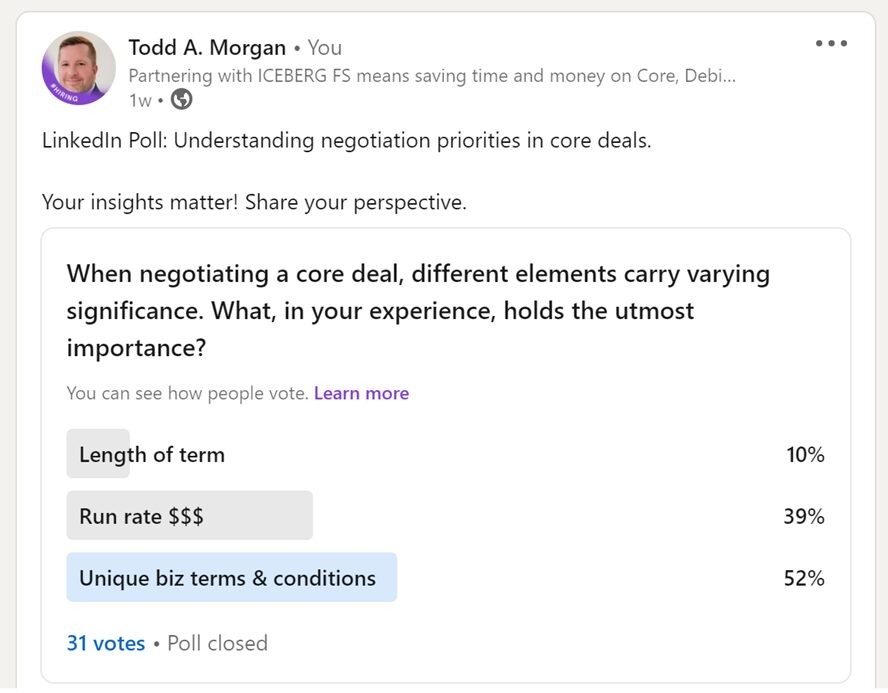

LinkedIn Poll: Understanding negotiation priorities in core deals

RECAP:

Last week, I ran a poll seeking insights on key components in a core contract. A big thank you to everyone who participated, including vendors and community bankers. Your insights are immensely valuable—thank you! “It’s called an agreement because it’s mutually beneficial to both parties”, as one mentor used to emphasize. Another often reminded me, “Seeing is believing”, highlighting the difference between the intended spirit of an agreement and its actual balanced outcome. Your contributions help align these perspectives for a better understanding.

The results are in! Of 31 votes: 10% for Length of Term, 39% for Run rate $$, and 52% for Unique biz terms & conditions. Thank you once again for your thoughtful participation. Your insights fuel ICEBERG FS commitment to providing valuable content and helping community bankers refocus on community building rather than vendor management.

I invite you to explore my detailed analysis and the poll results below. Your engagement is what makes our community vibrant and informed. Let’s continue shaping meaningful discussions together!

COMPREHENSIVE ANALYSIS:

At ICEBERG FS, we understand the unique challenges community bankers face. We often emphasize that your contracts cast a large shadow, but our expertise lies in minimizing this “shadow” to facilitate smoother business interactions. Our goal is to provide customized solutions that reduce the impact of your contracts, aligning them more closely with your specific business requirements. Because no two deals are alike.

Improving a contract involves a delicate balance, much like the interplay between sunlight and the shadows cast by objects. The sun’s position affects the length and intensity of shadows, just as various contract elements influence its impact on a business relationship. Consider how adjusting the contract’s duration, financial aspects, and specific terms mirrors the dynamic relationship between sunlight, shadows, and the objects they cast upon. Let’s explore this analogy to understand how refining these contract components can strategically alter their overall influence.

1. Term Length’s Influence: The duration of a contract acts much like the height of an object casting a shadow. Shifting from a 10-year to a 5-year term diminishes the “height” of the contract, reducing its long-term impact. This adjustment aims to secure more agile and adaptable terms that align closely with evolving business strategies. Often, there’s a common belief that such agile terms are only achievable in longer-term deals, but our aim is to challenge this notion and achieve flexibility within shorter-term agreements.

2. Reducing Costs/Run Rates: Like increasing sunlight intensity at high noon, reducing costs in the contract lessens the financial “shadow.” Lowering commitments or enhancing efficiency decreases the contract’s overall influence. Implementing cost compression strategies that complement your business further diminishes the financial burden imposed by the contract’s terms and conditions.

3. Crafting for Your Strategy: Streamlining the contract aims to precisely align it with your strategy, much like adjusting sunlight to fit specific needs and casting a more tailored shadow. Introducing unique terms sharpens focus, reducing the contract’s impact, and tailoring it to fit your strategy, all while seeking enhanced conditions, irrespective of the contract’s length. This approach guarantees that, even within a shorter contract term, the negotiated terms and conditions serve the #communitybanks needs, strategy, and direction.

CONCLUSION:

By making strategic adjustments to contract duration, costs, and terms, you reduce their overall impact and better align them with your business strategy. This approach ensures that contracts complement your business, rather than overshadowing it.

POLL RESULTS: