Our Professional Experience

About ICEBERG FS

Analysis and Expert Guidance for Financial System Decisions

In today's business landscape, mistakes and missed opportunities can have significant repercussions, affecting both investments and customer satisfaction. With financial resources being precious, wasting money and time is a luxury no one can afford. Evaluating your current provider is the starting point; be it Core, Debit, and or Digital. We assess your potential exit costs and gauge your satisfaction level—whether you are content, neutral, or dissatisfied. Identifying exit costs is crucial for negotiation leverage.

If you remain with your current provider, we will secure optimal pricing, favorable terms, and conditions, and ultimately save you valuable time and resources. This cost-effective approach enables you to reinvest these savings within your bank and community, fostering growth and impact.

Changing providers entails more expenses than just the quoted price; additional services to fill gaps contribute to the overall cost of switching. Nevertheless, if you're determined to proceed, we offer a detailed comparison to aid your decision-making. We excel at clarifying complex situations, unraveling intricacies, dependencies, and variables present among financial service providers.

Mitigating risks is vital. Trying to evaluate and negotiate without expertise risks overlooking hidden fees, functional changes impacting operations, choosing an unsuitable solution, and facing change management challenges. Making such decisions without guidance can be painful. Our aim is to help you understand and navigate the iceberg and complexity effectively.

Selecting a core, debit, or digital provider carries immense weight. Committing to a 5-7-10 year partnership shapes your bank's operations for a significant duration. Ensuring adaptability to a changing market and customer expectations is crucial. Flexibility in terms and conditions is as essential as cost savings for a decade-long deal.

Leveraging Experience

Our expertise is grounded in daily involvement and decades of observations. We work with peers in your position, deciphering product nuances, deciphering billing intricacies, uncovering cost manipulation tactics, and teaching the inside baseball of core, debit, and digital service providers. Partnering with an expert prevents missed opportunities. While you might handle pricing and features well, overlooked aspects could lead to regrets.

Competitive Landscape

The banking sector is fiercely competitive, especially for community banks. Making the right choice is imperative to reduce risk, downtime, and ownership costs. Unlike larger entities, we're solely focused on your success, offering free Assessments, comprehensive Evaluations, Renewals, Negotiations, and Project and Vendor Management services.

Process and Comparison

The vendor review and selection process community banks go through includes years of strategic planning, annual budgeting, steering committees, special projects, change control, variance reporting, compliance, and safety and soundness exams, all while executing the daily operations and the essence of community banking: building communities.

Your vendor projects can get lost in the shuffle quite easily. Our approach factors in your bank’s strategic plan and desired outcomes. We provide a holistic view of renewing versus switching providers and systems. Our linear process streamlines your vendor review and selection process into Analyze, Decide, Implement, and Assess results. We stand by your side from the beginning of the project through the maturity date(s) of the contracts we helped you negotiate.

Contrasting Traditional Approach

Traditional vendor review and selection processes lack a comprehensive perspective. They may assess costs without fully grasping exit expenses, hidden fees, gap analysis of existing vs new solutions, and often guess on terms and conditions. They aren’t linear. They aren’t dynamic enough. They are often a colossal misuse of time and resources. We know because we’ve observed dozens of community banks go through the process without the right help and guidance.

Common Pitfalls and Underestimations

When you don’t have the right help during analysis and decision making, time and cost are frequently underestimated. Negotiations are less fruitful without proper analysis and planning. Challenges arise in areas like customer-facing changes and client interactions, which are found in the assessment period after you go live or after you renew your services.

Our Method in Summary

Our method ensures a more and well-informed decision-making process along with a fair price. We listen to you and observe your business. By doing that we will provide you with the service and the results that you want. We aren’t satisfied until you are.

In summary, we offer analysis, expertise, and tailored outcomes to guide your core, debit, and digital decisions. In an ever-competitive banking industry, making informed decisions with a focus on flexibility, efficiency, and time and cost savings is paramount.

Let us streamline your Core, Debit, and Digital negotiations and save you hundreds of hours. We view these as major project management endeavors, and our extensive experience includes tens of thousands of hours dedicated to overseeing critical projects for community banks.

120 hrs

Avg Time Saved

$1.7M

Avg Savings Per Deal

Our track record boasts an average savings of $1.7 million per deal. Join forces with us, and benefit from our unique perspective that uncovers opportunities others may miss.

Being part of the same institution that draws your top talents is a source of pride. Remarkably, our status as the sole vendor in our graduating class at Barret School of Banking sets us apart. Our primary goal is to advance our understanding of community banking and, in turn, provide enhanced service to bankers.

Banking School

200

Onsite Visits

Over the past eight years, we've engaged with 200 community bankers directly in their own environments. We've closely observed their bank operations and staff, immersed ourselves in their communities, and deeply reflected on these invaluable experiences.

We've successfully negotiated 350 contracts, serving both community bankers and Fortune 200 companies. Our expertise allows us to uncover opportunities and insights that others may overlook.

350

Contracts Negotiated

55

Conferences, User Groups,

& Local Events

We're committed to investing in you. Over the past eight years, we've actively participated in 55 local events, demonstrating our dedication to supporting your communities.

With memberships in 10 state associations, we've gained extensive knowledge from both you and your peers in the industry.

10

State Association Memberships

500

Projects Managed

We have a proven track record in managing a wide range of implementations, encompassing ancillary products, online banking conversions, and core conversions, both through remote and on-site processes. Additionally, we have actively participated in debit and credit card conversions. Our profound comprehension of these intricacies positions us to skillfully communicate crucial information to primary stakeholders and executive leadership.

Since 2008, we've been actively engaged in conversations with community bankers from across the country. Our unwavering commitment to a service-first mindset has driven us to actively listen and uncover the challenges and issues faced by our clients, always striving for the best possible outcomes.

4,000

Cases Worked

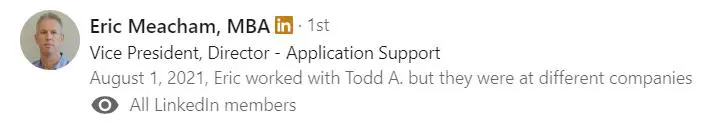

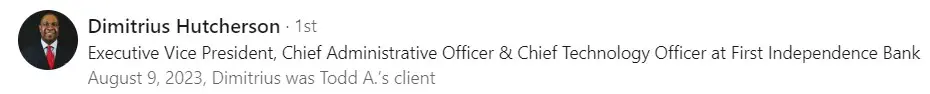

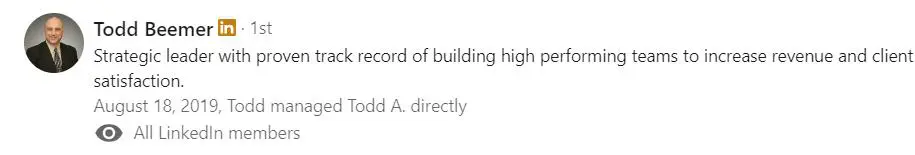

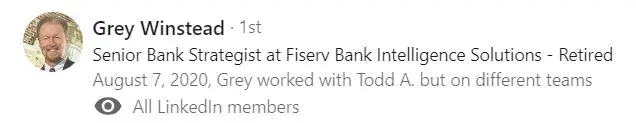

Recommendations

Recommendations From Customers

Recommendations from Industry Leaders

Recommendations From Former Co-Workers

Recommendations from Former Associates